Irs Schedule 1 2024 – Earlier this month, the IRS announced key tax code changes, including increases to 2024 federal income tax brackets and the standard deduction. These increases were made in response to sticky . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

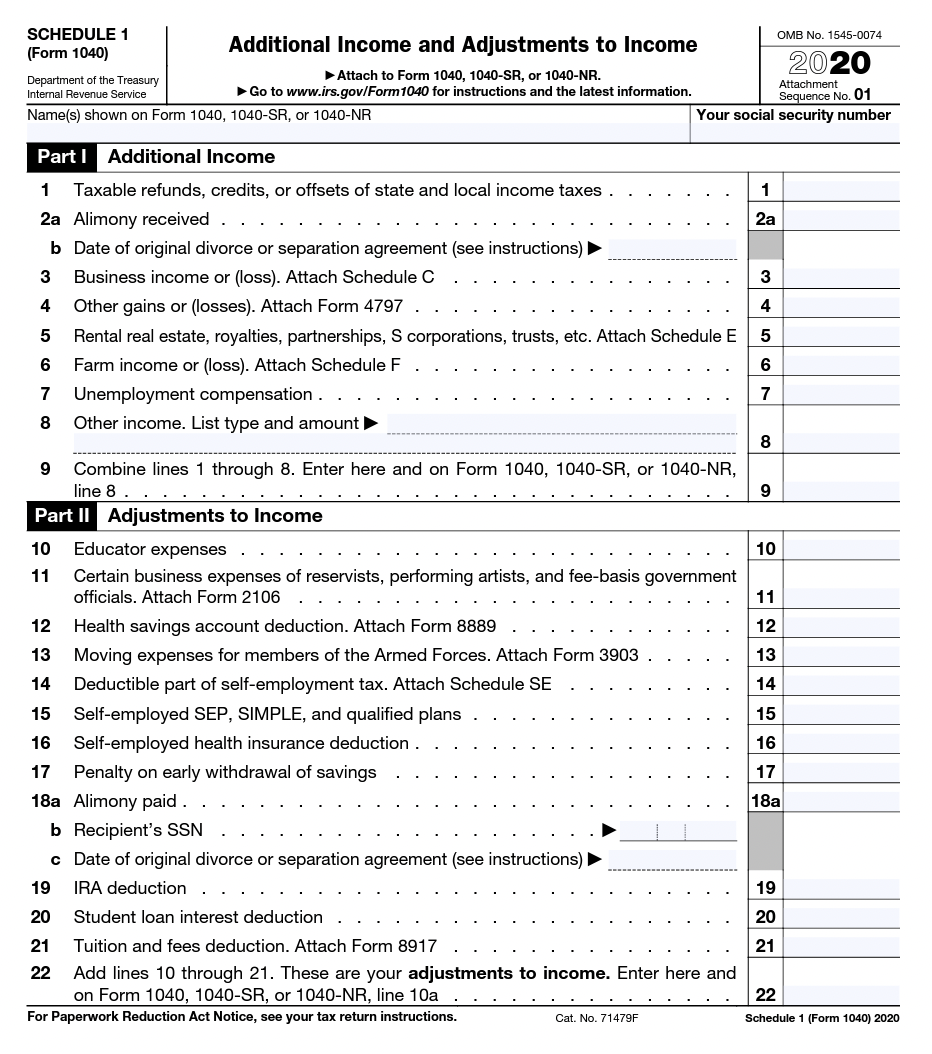

Irs Schedule 1 2024

Source : www.irs.gov

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

Why Pre file Form 2290 on Tax2290.com?

Source : blog.tax2290.com

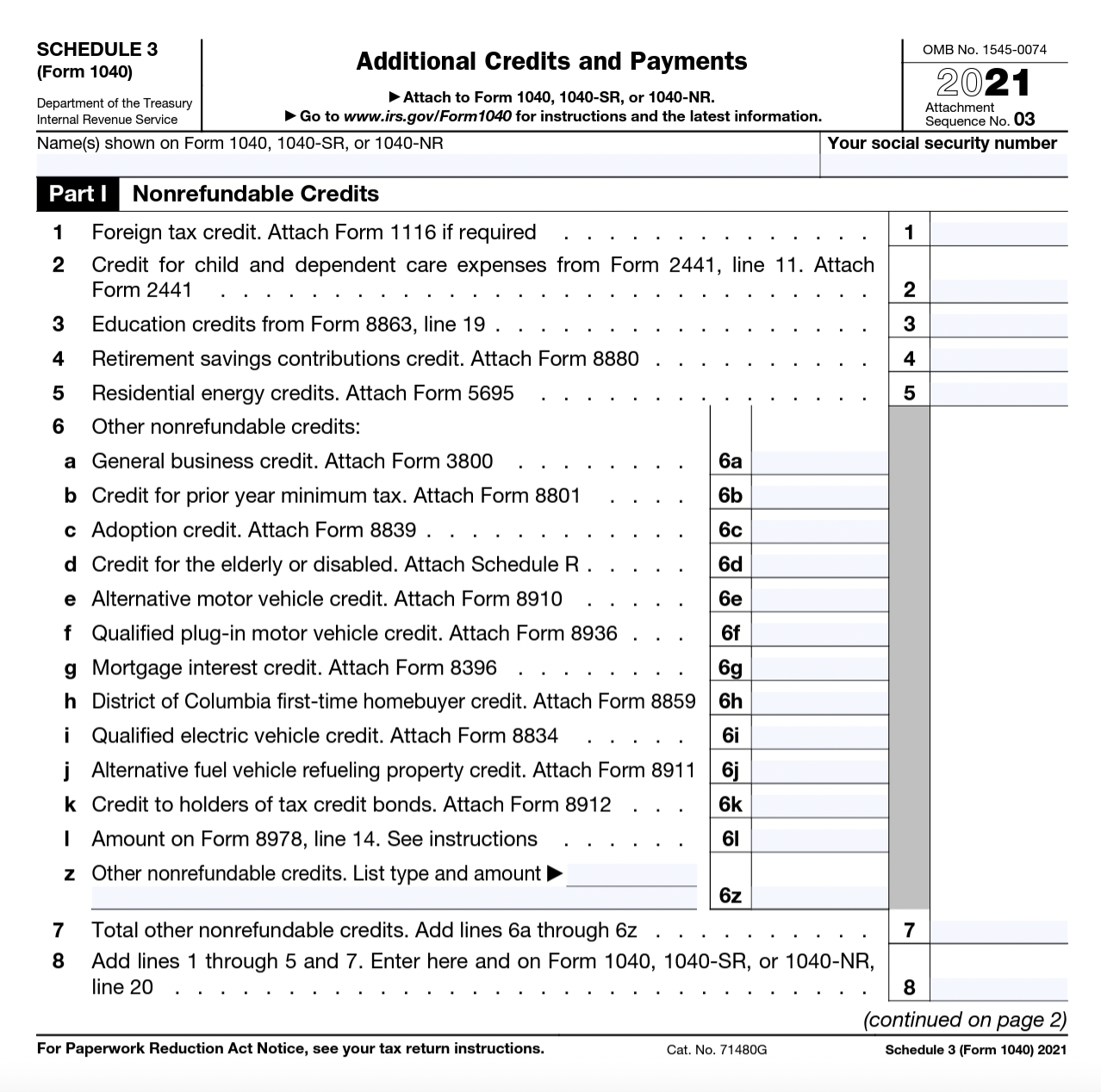

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS to Require Electronic Filing for ACA Reporting in 2024

Source : www.newfront.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

FSA Archives Admin America

Source : adminamerica.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Irs Schedule 1 2024 Publication 505 (2023), Tax Withholding and Estimated Tax : IRS adjusting have a new 2024 contribution limit of $4,150 for single taxpayers, an increase of 7.8%, while the contribution limit for families will increase to $8,300, or a 7.1% increase . The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which .